Global case studies are increasingly demonstrating the value of microfinance, often built on fintech platforms. Microfinance is proving to be an effective gateway to financial inclusion. In this article we’ll examine the advantages of accessing microfinance products available on the Pakistani market and how they are helping to drive economic growth on an individual and national level.

A survey conducted by InterMedia’s Financial Inclusion Insights (FII) demonstrates a number of persisting problems in Pakistan’s goal to reach higher financial inclusion. Firstly, despite the State Bank of Pakistan (SBP)’s ambitious five-year target to expand financial access to at least 50% of adults by 2020, the dial barely moved between 2015 and 2016 (2017 data is not yet available). While access to financial services improved very slightly, from 15% to 16%, financial inclusion, defined as adults who have an account in their name with a full-service financial institution, remained stagnant at 9% of the population.

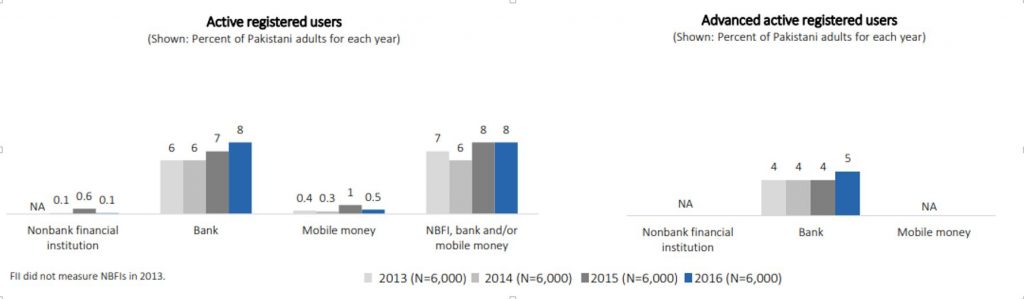

Secondly, active and advanced use of mobile money services such as mobile phone-based digital wallets actually dropped. The number of mobile money service users who paid bills through their accounts dropped from 40% in 2015 to 29% in 2016. Active users dropped from 1% to 0.5%. 1 in 10 Pakistani adults use mobile money services but 93% do so through OTC transactions. They said that they preferred to use OTC transactions because they didn’t see why executing transactions directly from their phone was a better option than using an agent.

Source: InterMedia Pakistan FII Tracker survey Wave 4 (N=6,000, 15+), September-October 2016/Finclusion.org

This regression in the adoption of financial services through mobile money providers highlights a problem. 10% of the population use the service but only 1% have a full account registered in their name. If users don’t officially register an account, they cannot subsequently use more advanced savings and credit services and it is these services that are key to stimulating economic development in Pakistan. This bottleneck is further evidenced by the fact the 1% increase in access to financial services has not resulted in any parallel increase to take-up.

Pakistani Citizens Do Save and Borrow

For meaningful economic development on a personal and national level to take place, as well as ensuring basic quality of life, every individual must have 3 basic needs met:

- The need to transact.

- The need to save.

- The need to borrow.

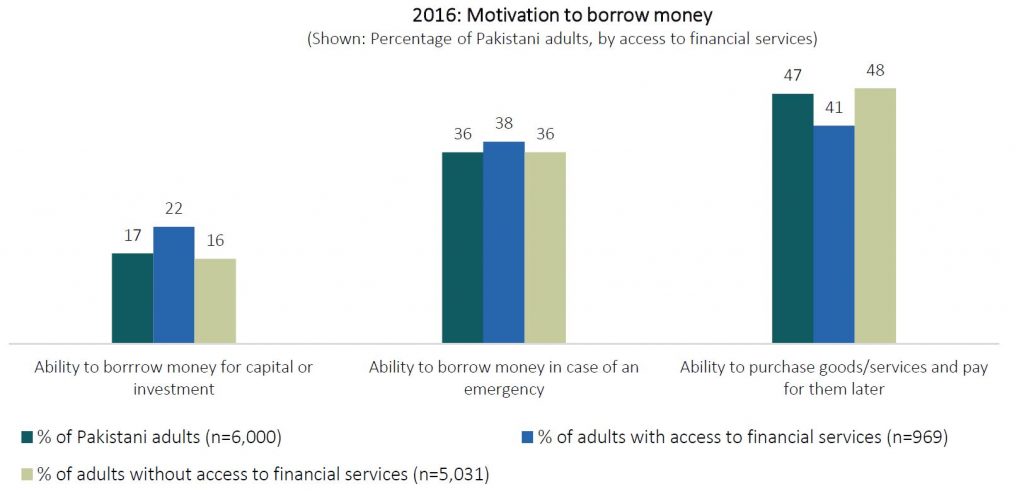

The FII 2016 survey results demonstrate that Pakistanis are transacting, saving and borrowing on a daily basis. Half of respondents said they had saved and 20% stated they had borrowed. The issue is they are doing so through cash and through informal channels. The chart below demonstrates that the motivation to borrow exists.

Source: http://finclusion.org[Financial inclusion Insights]

17% of Pakistani adults are motivated to borrow in order to access investment capital – the fuel of any economy. However, the low value and volume of individual loans taken out through formal financial institutions suggests the credit and loan products being offered to not meet the needs and demands of enough Pakistanis. This is excluding the unbanked population from the means to develop financially. The financial institutions themselves also do not seem to have the incentive to create products tailored to these needs and demands.

Microfinance as a Gateway to Financial Inclusion

‘Microfinance is providing financial services to the low income people of the world’ – M. Mudassar Aqil, CEO Finca Microfinance Bank.

Pakistan’s economic engine is micro enterprises and small farming holdings of less than 5 acres. 75% of the urban population derive their income from the former and 80% of the rural population from the latter. The traditional finance sector is not catering to the needs of this economic reality.

Microfinance does not only refer to micro credit products but a range of financial services tailored to lower income individuals and households. Microfinance products help ‘smooth out’ the instability of cash flow that is inherent to low income live and micro enterprises. Removing the stress, disruption and damage to micro business growth potential these cash flow gaps lead to both hugely improves the quality of life of beneficiaries as well as facilitating the potential for economic growth. It is estimated that around 24 million Pakistanis would benefit from and wish to be offered access to microfinance products. However, currently only 4.3 million do, meaning another 20 million are missing out on the opportunities microfinance products would provide them access to.

Fintech’s Role

The role of fintech in bringing microfinance products to currently unbanked sections of the population in Pakistan and other emerging economies has been strongly supported. An estimation made in a recent McKinsey Global Institute report “How digital finance could boost growth in emerging economies”,indicates Pakistan’s digital finance market has the potential to reach $36 Billion by 2025, providing a 7% boost to the GDP, the creation of 4 million new jobs and $263 billion in deposits held with banks or non-bank finance companies.

The prevalence of mobile phone ownership in Pakistan, even if low-tech older generation models are the norm, means they are an effective distribution platform for microfinance products in more remote areas. However, the low number of registered mobile money accounts and drop in the number of transactions being made from registered accounts in favour of a reversion to OTC demonstrates that fintech platforms still face challenges. Nonetheless, the potential is clear. Trust and financial literacy needs time and active support to grow if financial services are to make greater inroads into replacing the cash economy and a smoother financial cycle for the low income population.

A big part of solving the challenges of financial inclusion is, however, tailoring products to fit the market. These products must meet the needs of individuals and be attractive to them. But for Pakistan’s microfinance system to work and develop sustainably, they also have to represent a viable business model for providers. Fintech’s role here is perhaps even greater than in the distribution platforms.

One of the greatest challenges to the viability of the microfinance business model is the lack of any credit or other financial history, and sometimes even personal identification and registration documents, of those whose needs it meets. Risk modelling based on big data and other technology advancements are helping fintech companies offer microfinance products in a sustainable way. Big data is also being harnessed to fine tune products and services to really meet the consumer needs they are designed to. Fintech is also driving the cost efficiencies that allow for affordable microfinance products and business models.

Pakistan has a long way to go to meet its stated 2020 financial inclusion goals. Ultimately, while the speed of progress towards these goals is important, steady progress is more important, even if its pace falls short of that which would be ideal.

Mawazna.com is a leading Pakistani financial services comparison and an aggregator platform. Mawazna aims to create an impact through masses by making their life easier when it comes to personal finance related decisions including microfinancing. Mawazna regularly creates financial awareness. Consumers can objectively compare and review pricing, features, and comprehensive information on a wide range of financial services and products available on the Pakistani market. Similarly Mawazna.com enables Providers with a new digital channel to reach their potential digital savvy customers. Financial services and product providers have the platform to access and present their offers to huge numbers of Pakistani consumers.